Lower income seniors renting in the private market may be eligible for a rent supplement through SAFER.

To submit documents during the Canada Post disruption please use our Program Upload Form.

If you have questions about your file, please call us at 604-433-2218 or 1-800-257-7756.

About the program

The Shelter Aid for Elderly Renters (SAFER) program helps make rents affordable for BC seniors with low to moderate incomes. SAFER provides monthly cash payments to subsidize rents for eligible BC residents who are age 60 or over. Existing clients need to reapply each year.

Find out how much rent help you could get. Get an estimate.

Rental Assistance Program Calculator

SAFER application documents:

Am I eligible?

To be eligible you must meet all of the following:

- You are age 60 or older.

- You lived in BC the full, 12-month period before submitting your application.

- You, and your spouse you share a home with, meet Canadian citizenship requirements:

- Individuals with private sponsorship that has broken down

- People who applied for refugee status

- Individuals legally in Canada as permanent residents, not under sponsorship

- Canadian citizens not under sponsorship

- You pay more than 30% of your gross, before tax, monthly household income towards rent for your home. If you live in a trailer, this includes pad rental (manufactured home) that you own and live in.

You will NOT be eligible if any of following are true:

- You live in subsidized housing

- You live in a residential care facility funded by the Ministry of Health

- You live in co-operative housing and are a shareholder

- You or your family receive income assistance through the BC Employment and Assistance Act or the Employment and Assistance for Persons with Disabilities Act (excluding Medical Services only)

- Your gross monthly income exceeds $3,103.33 monthly (or $37,240 annually)

3. Submit your Application

You can submit your application in the following ways:

- Online: Scan and save, then submit completed application to our: Program Upload Form

- In person: Drop off completed applications to the nearest BC Housing office.

- By fax: Completed application forms and a copy of supporting documents can be faxed to 604-439-4729

- By mail: Shelter Aid For Elderly Renters Program, BC Housing, 101-4555 Kingsway, Burnaby, BC, V5H 4V8

Please do not include any original documents, only photocopies.

Once we process your application we will contact you to let you know if you are approved, ineligible or we need more information.

Application Process & How to Apply

1. Download and complete application form

There are two ways to get an application form for SAFER:

- Online: Download an SAFER Application Form, or

- By mail: Request a paper copy of the application form by calling 604-433-2218 or 1-800-257-7756

2. Attach your supporting documents

This section corresponds to the "SAFER Application Checklist". Please include the following supporting documents with your application:

Proof of Income

When applying for the Shelter Aid For Elderly Renters (SAFER) program, the following sections of the application form will require supporting documents:

This section corresponds to the "Application Checklist / Proof of Income" section of the application form. See last page for application checklist. Please provide the following supporting documentation:

1) Tax Information*

You must submit copies of both of the following tax documents for yourself and your spouse (if applicable ) to determine your eligibility and possible benefit entitlement amount.

There are two ways that you can provide your tax information:

- Provide consent for Canada Revenue Agency (CRA) to release to BC Housing information from your tax records. Consent can be provided by completing the SAFER Income Verification Request Form ; or

- Provide copies of both:

- Last year's Income Tax Return - An Income Tax Return Form is an official document on which one is required to list income amounts, deductions, contributions and related financial information for tax reasons.

- Income Tax Notice of Assessment - A Notice of Assessment (example) (T451) acts as proof of Canada Revenue Agencies’ confirmation of the given year’s income.

- Log into your CRA My Account and print your assessment; or

- Call CRA at 1-800-959-8281 or 1-800-959-2221 to request an Option C print.

2) Proof of current gross monthly income

Please provide photocopies of your current gross monthly income from the following sources:

- Cheques or cheque stubs (minimum three most recent - must show gross pay and deductions)

- Bank statements showing direct deposit, T-slips or other income statement(s)

- If you or your spouse (if applicable) are newly working please provide a letter from employer stating your monthly or annual gross salary

3) Self-Employment or business income (if applicable)

If your household income from last year included income from self employment, please provide a copy of Income and Expenses (T2124 - Statement of Business Activities) from last year’s Income Tax return

Please note: Those receiving Income Assistance are not eligible for the Shelter Aid for Elderly Renters (SAFER) until their Income Assistance has ended and their Income Assistance file is closed. Existing Shelter Aid for Elderly Renters (SAFER) recipients who begin to receive Income Assistance, whether for themselves or spouse, must contact BC Housing within the same month to avoid an overpayment.

Note: The above sections correspond to the application form. All information collected is for the purpose of determining eligibility and is kept strictly confidential.

4) BC Bus Pass T5007 Tax Slip (if applicable)

If you (or your spouse) received a T5 slip from the BC Bus Pass Program last year, attach a copy of the T5007 Tax Slip. This form shows the bus pass benefit amount (in box 11 of the T-Slip). This amount will be excluded from your income.

Proof of Age

For those over the age of 65 and in receipt of Old Age Security (OAS), proof of age is not required.

To be eligible for SAFER, you and/or your spouse must also be a Canadian citizen, a permanent resident or a refugee claimant and over the age of.

Please also provide a photocopy of one (1) of the following as proof of age for you and/or your spouse.

Birth or Baptismal Certificate - For those born in Canada, please provide a photocopy of your Canadian birth certificate. If you are not able to find your birth certificate, you will need to contact Service Canada for the province or territory of your birth to obtain a copy. To find the website for your province or territory please visit the Service Canada website.

Driver’s Licence - For those that have a driver's licence, please provide a photocopy.

Passport - For those that have a passport, please provide a photocopy.

Proof of Rent

To determine the amount of assistance for which you your may be eligible, you need to provide information showing what you and/or spouse is paying in rent.

Please provide a photocopy of one (1) of the following as proof of your rental amount:

- Your Residential Tenancy Agreement

- If your tenancy agreement is more than 12 months old, we also require one additional item from this list

- This sample tenancy agreement is provided courtesy of the Residential Tenancy Branch of B.C. Your tenancy agreement may look different.

- Notice of most recent rent increase

- Rent receipt (no more than three months old) confirming:

- Your name, rental amount, and address

- Date

- Landlord's name, telephone number, and signature

- Most recent rent cheque cleared by your bank

- Copy must show the front and back

- Must be stamped by the bank

If you are unable to provide one of the proofs listed above, please have your landlord, building manager or building owner complete the Landlord Declaration section on page 4 of the SAFER application form

Bank Information

Payment by direct deposit is simple, quick, and convenient. Your payment is made directly into your account with no need to deposit a cheque or make a trip to the bank. This reduces turn around time for your payment and makes is easier to audit.

To receive your Shelter Aid by direct deposit:

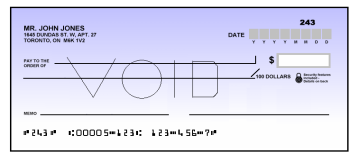

If you are a new SAFER applicant, either attach a VOID cheque or complete the SAFER - Direct Deposit Form on page 7 of the SAFER Application Form .

If you are an existing SAFER client, please submit either a VOID cheque or letter from your bank showing your bank account information and bearing the bank's stamp. The cheque or letter must have your SAFER account number written on it.

An acceptable VOID cheque must be personalized by the bank. We will not accept cheques with hand-written information in the top-left corner.

Submit your Application

You can submit your application in the following ways:

- Online: Scan and save, then submit completed application to our: Program Upload Form

- In person: Drop off completed applications to the nearest BC Housing office.

- By fax: Completed application forms and a copy of supporting documents can be faxed to 604-439-4729

- By mail: Shelter Aid For Elderly Renters Program, BC Housing, 101-4555 Kingsway, Burnaby, BC, V5H 4V8

Please do not include any original documents, only photocopies.

Once we process your application we will contact you to let you know if you are approved, ineligible or we need more information.

Frequently Asked Questions

Application Questions

How will I know if my SAFER application is approved?

- BC Housing will contact you by mail.

How is the rent subsidy calculated if I pay room and board?

- If two or more meals per day, care, or personal services are included in the Rent amount, the Recipient is considered to be paying Room and Board. Rent is to be paid equal to fifty per cent of the total amount paid for Room and Board, regardless of the actual amount paid for the room portion.

Eligibility Questions

What are the citizenship requirements?

- Applicants must permanently live in British Columbia when applying, and each member of the household must be one of the following:

- Canadian citizens not under sponsorship

- Legal Canadian permanent residents not under sponsorship

- People who have applied for refugee status

- Individuals for whom private sponsorship has broken down

My family sponsored me to come to Canada. Am I eligible?

- No. Seniors who are in Canada under a sponsorship are not eligible for subsidy while the sponsorship agreement is in place.

May I apply for the SAFER rent subsidy if I am in a Long-Term Care facility or in a residence that is subsidized through another government agency?

- No. Seniors residing in a Long-Term Care facility or in a residence that is subsidized through another government agency are not eligible for subsidy.

I received a T5007 Tax Slip from the BC Bus Pass Program. Does this impact SAFER eligibility or benefit amounts?

- No. Being in receipt of the bus pass does not impact eligibility for SAFER or the SAFER benefit amount. However, we ask that you provide a copy of the T5007 tax slip with your application or reapplication so that we can exclude this amount from your income.

What are the Maximum Rent Ceilings?

Effective August 2024 the maximum rent ceiling is $931.00 for both singles and couples in all communities across BC.

Before August 2024 the rent ceilings were different for singles and couples and location in the province:

- Zone 1

- Singles - $803

- Couples - $866

Aldergrove, Anmore, Belcarra, Bowen Island, Burnaby, Coquitlam, Delta, Langley, Lions Bay, North Vancouver, Maple Ridge, Milner, New Westminster, Pitt Meadows, Port Coquitlam, Port Moody, Richmond, Surrey, Tsawwassen, Vancouver, West Vancouver and White Rock

- Zone 2

- Singles - $767

- Couples - $836

Abbotsford, Agassiz, Central Saanich, Chase, Colwood, Dawson Creek, Esquimalt, Fort St. John, Highlands, Kamloops, Kelowna, Lake Country, Langford, Lantzville, Logan Lake, Metchosin, Mission, Nanaimo, New Songhees, North Saanich, Oak Bay, Peachland, Penticton, Prince George, Saanich, Saanichton, Sidney, Sooke, Squamish, Terrace, Union Bay, Victoria, View Royal and West Kelowna

- Zone 3

- Singles - $734

- Couples - $800

All Other Areas of the Province

Program & Payment Questions

How is the SAFER subsidy paid?

- Assistance is paid by direct deposit to your bank account on the last working day of the month. You will need to provide us with a VOID cheque or a Preauthorized Debit Form from your bank. If you do not currently have a bank account, you will need to open one.

When will my SAFER subsidy start?

- If you are eligible, your subsidy will start the month your application is received in our office. For example, if an application is received on July 29, it will start the month of July. The SAFER subsidy is paid in arrears—In this case, July payment would be made at the end of the month.

Is there a minimum amount that SAFER will pay me?

- Yes, the minimum is $50 per month.

What if I need to change my bank information?

- You can change your bank information by forwarding BC Housing a copy of a blank cheque marked "void" or a pre-authorized debit form completed by your bank.

What if I am unable to use direct deposit?

- Please call us directly: 604-433-2218 or (outside Metro Vancouver) 1-800-257-7756.

Do I ever need to reapply for SAFER?

- Yes. Each year a reapplication form will be sent to you three months before your birthday. You must complete and return the reapplication to continue getting a subsidy.

I received a rent increase, what do I do?

- Please forward a copy of the rent increase notice to the SAFER office. Your file will be updated and, if applicable, your subsidy adjusted.

Please note, if your rent is over the maximum allowable rent ceiling you may not receive an increase to your subsidy. Knowing your actual rent amount is important for us. This way we can better understand rental conditions when we later review the SAFER program.

I am moving, how do I get my subsidy transferred?

- Contact the SAFER office immediately. The SAFER office will also require that you forward by mail a copy of your tenancy agreement or other proof of tenancy and rent. Please be prepared to provide the following information:

- Effective date of move

- New address

- New rent amount

- New landlord's name and contact information

- Details on anyone who will be living with you at the new address (if applicable).

My income changed; do I need to let you know?

- Please inform BC Housing immediately so that we can make any necessary changes to your file. This does not include the cost of living increases to income such as CPP or OAS.

Do I declare my SAFER subsidy on my annual income tax return?

- Yes. SAFER is a non-taxable rent benefit but must be declared on your taxes.

Do you have a question? Talk to someone at BC Housing. Call 604-433-2218 or 1-800-257-7756.